Balanced to buyer’s market conditions are expected to persist in 2026 depending on property type and location.

Courtesy of CREB®

January 22, 2026

In 2025, housing market activity in Calgary and area transitioned from one that favored the seller to more balanced conditions as improving supply in the new home, rental and resale markets occurred just as demand returned to more typical levels, mostly due to slower migration levels. This took much of the pressure off home prices, especially in the apartment and row segments, which reported the largest gains in supply compared to

long-term trends. As we move into 2026, supply levels are expected to remain elevated for higher density homes, as 2025’s record high starts will continue to add supply to the rental and new home market as those units are completed. The elevated inventory levels should cool new home starts this year, taking the pressure off supply growth by the end of 2026 and into 2027.

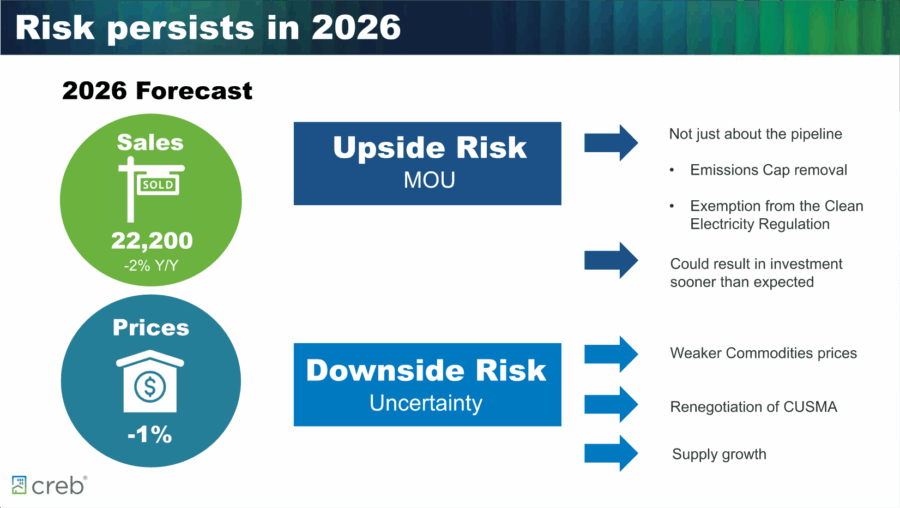

Previous population gains and job growth are expected to keep sales in line with long-term trends. But no further uptick in demand is expected given the shift in migration and employment in the city. The recent MOU regarding new pipeline development and shifts in regulatory policy, signed by the provincial and federal government, provides significant upside for our city and province should progress be made. However, the economic benefits would not be expected to influence the housing market this year. Elevated supply across new, resale and rental markets, combined with stable demand, is expected to prolong the time it takes to absorb the additional resale supply currently in the market. Overall, balanced to buyer’s market conditions are expected to persist in 2026 depending on the property type. The additional supply in the apartment and row segments of the market are expected to weigh on resale prices in those segments. Meanwhile, annual prices should stabilize in the more balanced detached and semi-detached segments. Nonetheless, further annual price declines for apartment and row-style homes will continue to weigh on total residential prices, which are expected to ease slightly over last year.

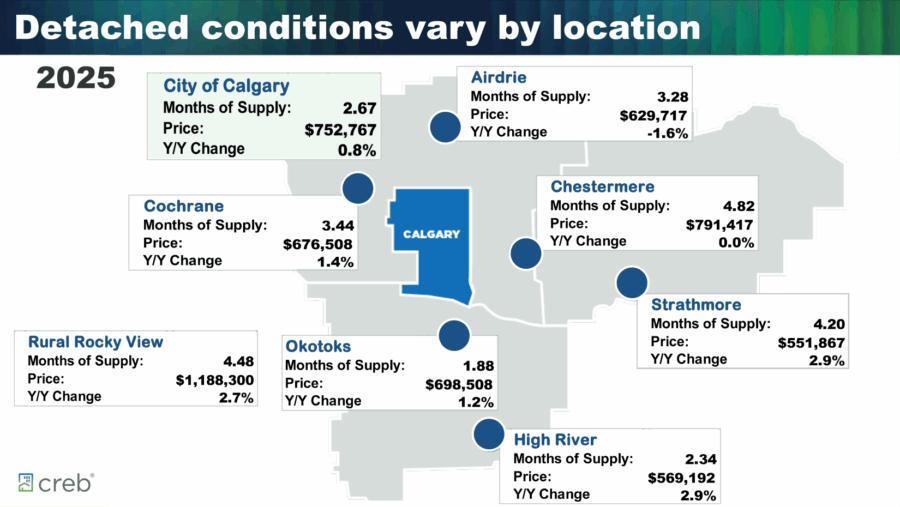

Calgary and Area Detached Homes:

Airdrie

Airdrie enters 2026 with balanced conditions, higher inventory, and less upward pressure on price.

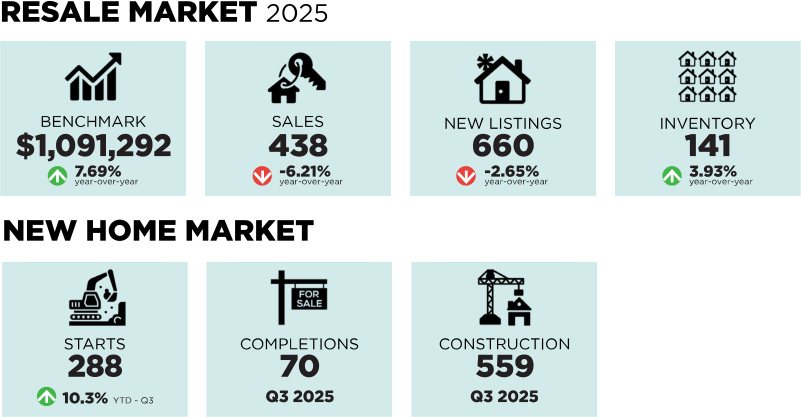

Following several years of strong demand and limited supply, activity in Airdrie shifted in 2025. Sales activity slowed to levels more consistent with long-term trends, while rising new listings compared to sales supported inventory gains and a return to balanced conditions.

The additional supply choice both in the resale and new home market took much of the pressure off home prices. While benchmark prices did trend down in 2025, they have not offset the exceptional gains reported over the previous four years. In fact, the annual detached benchmark price of $629,717 is still 40 per cent higher than annual levels reported in 2021.

Cochrane

With supply now closer to historical norms, price growth is expected to moderate heading into 2026.

Following four consecutive years of low inventory levels, a significant rise in new listings relative to sales activity accompanied by more new home supply choice helped bring supply levels back in line with long-term trends. Unlike other areas, sales activity remained relatively stable in the Cochrane market compared to 2024, and activity was still higher than long-term averages.

The relatively high level of sales did help offset the impact of higher inventory levels and the months of supply averaged just over three months in 2025.

The shift toward more balanced conditions and additional supply choice only occurred in the second half of the year, limiting the impact on prices in 2025. Despite some recent pullbacks, on an annual basis benchmark prices rose over 2024, and detached prices hit a new annual record high at $676,508.

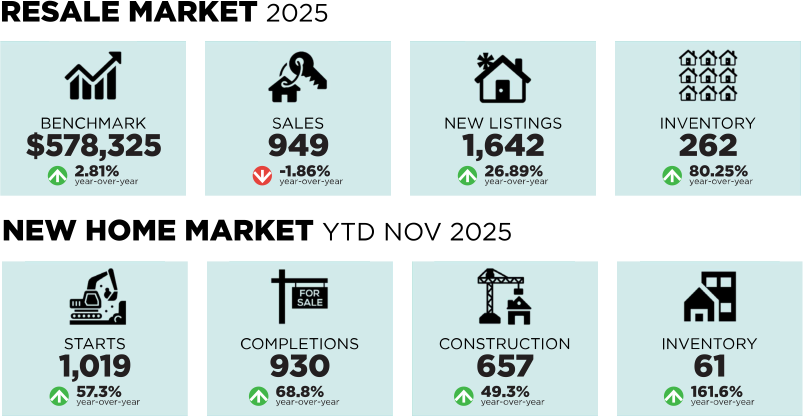

Canmore

Recent developments regarding a vacancy tax could influence market activity in 2026.

Sales in the Canmore area were slightly slower than 2024 levels, mostly due to pullbacks in the apartment

condominium side of the market. However, the decline in apartment-style units was likely due to limited supply choice as the sales-to-new listings ratio remained near 70 per cent, the highest out of all property types.

Apartment condominiums account for over 40 per cent of all the sales in the area, likely due to the popularity of the area for tourism activity and the higher price for all other property types. Tighter conditions for apartment-style units resulted in further price growth, with annual gains of nine per cent.

While the pace of growth has slowed thanks to additional supply choice in the new home sector, price growth has been exceptionally strong for apartment-style units, increasing by 42 per cent over 2021 levels and reaching a new record high at $822,674. Apartment-style units are the most affordable option in the town with benchmark prices ranging from $1.1 million for a row home to $1.7 million for a detached home.